Pet business insurance is vital for protection. It offers peace of mind, legal defense, and builds customer trust. Key coverages include General Liability, Professional Liability, Property, Workers’ Compensation, and Commercial Vehicle insurance. Your specific needs depend on the service you require, such as grooming or daycare. Choose providers specializing in pet businesses. Evaluate coverage limits, understand the claims process, and balance cost with protection. Avoid skipping coverage, ignoring the fine print, or underestimating risks, such as bites. A thorough policy safeguards your business, clients, and future.

This is you right now: your dream of running a grooming salon, dog daycare, or training service has become a reality. And now you are asking yourself, what else can I do? Best believe it is pet business insurance. This is what protects your business from unforeseen costs. Regardless of whether you have been a professional in this business for years or are new to it, understanding how pet business insurance fits into the overall operation of your business is crucial to your business’s safety and future.

In this article, we will cover everything you need to know about pet business insurance and answer some common questions, such as ‘why is it important?’ and how to choose the best insurance plan for your business. By the end, we want you to have the confidence to make choices that will help protect your business and the people who use your services.

Why Pet Business Insurance Matters

A 2025 survey by the North American Pet Health Insurance Association (NAPHIA) found that there was a steady increase in the number of pet businesses purchasing insurance across the United States in the Dog kennel industry.

The reason behind this trend was the increased risk of being held liable for accidents or injuries, as well as the increasing client expectations. For instance, let’s say a dog slipped off the grooming table and sustained an injury. Or a client tripped over a leash in your daycare.

Regardless of whether it was your fault or not, if you don’t have the right pet business liability coverage, you will be responsible for paying the cost of the damages.

So why does it matter?

A. Peace of Mind

Having pet care business protection affords you the peace of mind that comes with knowing you have a financial cushion to fall back on when things go south. This way, you can ease your mind on other things and focus on your service without constantly worrying about it.

B. Legal Protection

Your insurance serves as a crucial layer of defense for your business. It covers court costs, as well as settlement costs in the event of litigation against your company due to accidents or property damage.

C. Customer Trust

If your business is insured, your customer feels more confident in placing their pets in your care. This demonstrates a sense of responsibility and professionalism on your part, resulting in improved customer relations and increased repeat business.

What Pet Business Insurance Covers

Like any other business insurance, this isn’t a one-size-fits-all solution. You will want your coverage to be specific and relevant to the type of service that your pet business offers.

A. General Liability Insurance

The general liability insurance typically covers third-party accidents or injuries occurring on the premises of your business, or during your rendered service. Say the dog you are walking scratched someone, or you forgot to put on the dog leash, and it went potty on someone’s lawn. Your general liability policy would cover any medical or settlement costs.

B. Professional Liability Insurance

Another term for this is ‘errors and omissions insurance.’ This insurance is beneficial to you if a client were to sue, claiming you were negligent or made a mistake in rendering a particular agreed-upon service. If you were pet-sitting and you accidentally fed the pet something they are allergic to, this insurance would cover these oversights.

C. Property Insurance

In the event of fire, theft, or flood damage to your facility, the property insurance safeguards your physical assets, equipment, and supplies.

D. Workers’ Compensation

This insurance type covers medical expenses and lost wages incurred if an employee is injured while working. This insurance is, in fact, required in many states. For such a high-stakes job, this type of insurance is especially important for the welfare of your employees.

E. Commercial Vehicle Insurance

Vehicle insurance is essential for mobile grooming services or pet transport businesses. This insurance covers accidents, damage, and liability involving business-owned vehicles used for pickups, drop-offs, or on-site services.

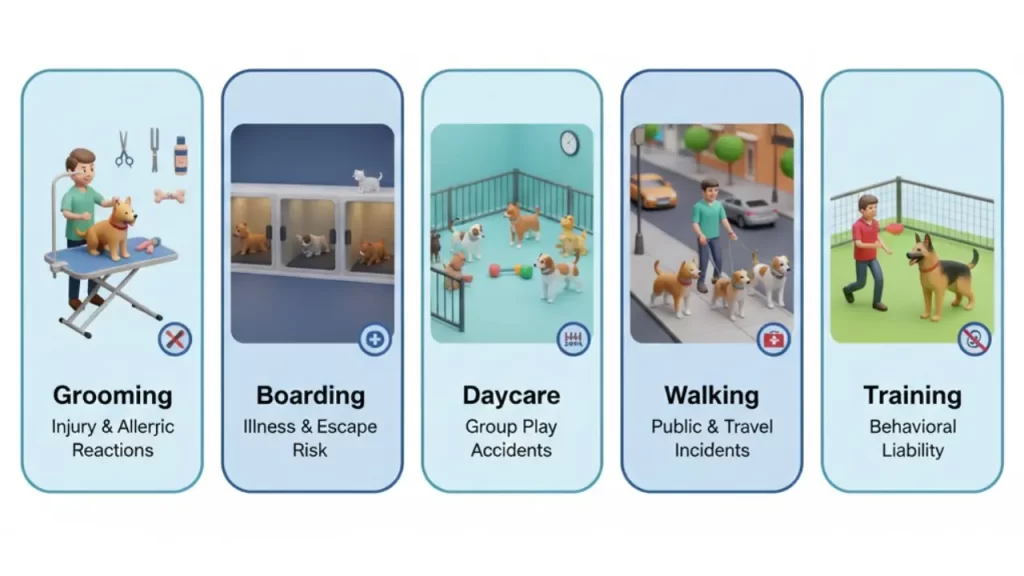

Different Pet Businesses, Different Needs

No two pet enterprises have the same set of risks. Consequently, your pet business insurance must be aligned to match your services. Let us take a look at how the various types of pet businesses can adjust their coverages and get the best possible protection.

A. Grooming

If you start a grooming business, your biggest concerns are injuries from sharp tools, allergic reactions to products, and damage to expensive grooming equipment. For this, you will need strong general liability coverage and property protection. A well-structured insurance policy for Professional pet Groomers should also include professional liability in case a client claims you mishandled their pet.

B. Boarding

Boarding facilities face different challenges. Pets staying overnight increases the risk of illness, escape, or injury. You will want pet Boarding service business coverage that includes medical liability and property insurance for your facility. If you transport animals, commercial vehicle coverage is also a consideration.

C. Daycare

Daycare Business operators usually deal with group play, but for pets, this can lead to fights, bites, or accidents. A general liability coverage would be beneficial in this situation and should include protection for injuries to both pets and clients.

D. Walking

Dog walkers do their work while on the move and often in public places. This means that there is a higher chance of injuries caused by the traffic accident, broken leashes, and the unpredictable behavior of pets. You will need to have coverage while on the move, and possibly a commercial policy, if driving between clients is part of your daily operations.

E. Training

A trainer comes highly at risk for unpredictable animal behavior. If the dog bites someone after it is trained, you might be held liable for damages. In this case, both professional liability and general coverage are necessary in the training room. If you are training from home or visiting clients, ensure that the coverages for your pet business include operations off the premises.

In other words, the best pet business insurance is the kind that fits that business. Whether it is grooming, boarding, walking, or training, the policy must cover the day-to-day activities and the associated risks.

How to Compare Pet Business Insurance Providers

Choosing the right pet business insurance provider is not all about finding the lowest cost. It also involves finding the right provider for you and your business. Here are some of the factors one should look for:

A. Coverage Limits

First, it is crucial to consider the coverage limits. This illustrates the amount you can recover from the insurance carrier in the event of a loss. If you have an expensive grooming salon with high-end equipment or if you have more than one pet with you at a time, you will want higher limits to avoid paying out of pocket.

B. Claim Process

Next, you should also look into how the claims process works for that insurance policy. It could be an otherwise good insurance company on paper; however, if their claim processing is slow, confusing, or challenging to work with, this can severely hinder your ability to get the help you need when you need it. Therefore, you want to ensure you are dealing with a reputable company that handles claims promptly and fairly.

C. Reliability

Select a provider who specializes in the pet trade, not just any business insurance. The companies that sell pet business insurance are more likely to provide the kind of coverage that is appropriate for you, thereby supporting your pet business better.

D. Price

Finally, you will want to consider costs. There are going to be many low-cost options out there to choose from, but don’t sacrifice the important things in favor of cheap policy coverage. When you find the policy that provides the most comprehensive results, it will typically strike an optimal balance between being economical and providing overall pet business liability protection.

After narrowing down your choice, spend some time reviewing each option. You can also compare pet business insurance through online comparison sites to view multiple service providers at once.

How to Choose the Best Pet Business Insurance

Finding the best insurance for your pet business begins with understanding your own risks.

1. Start by listing the services you provide

The best place to start is to identify all of the services that your pet business offers, then match them with their corresponding risks. For example, if you are grooming pets, one of the risks to be aware of is injury from sharp tools or an allergic reaction during the grooming session. If you run a dog daycare facility, group play can lead to bites or accidents during the activity, which must be accounted for. Each service has its own potential issues, and these should be addressed through your insurance plan.

2. Match them with the right type of protection.

After listing the risks, consider the type of coverage necessary to protect them. You’d find that general liability insurance is a must for all kinds of pet businesses. Likewise, if your company offers specialized services, such as training or grooming, you can add professional liability coverage.

Property insurance is also a must-have if you own your business space. In most states in the U.S., workers’ compensation insurance is required. And if the business involves transporting, commercial vehicle coverage will be helpful.

General liability is a must for all pet businesses. If you offer specialized services, such as training or grooming, consider adding a professional liability policy. If you own your own establishment, property coverage is a must. If you have employees, workers’ compensation is required in most states. And if you drive a vehicle for work, don’t forget commercial vehicle coverage. These several layers of plans create a complete insurance plan for pet professionals.

3. Cost

Now, let’s discuss the amount involved. Balancing cost with protection is vital. You do not want to have to pay for coverage that you will never need. On the other hand, you do not want to skimp on your protection. Look for the pet insurance coverage for small businesses that have flexible plans. Some plans allow you to begin coverage with basic coverage and add more as you grow. This is especially beneficial for new entrepreneurs and part-time operators.

4. Check Reviews

Before you decide, don’t forget to read through feedback from other pet professionals. Check what others are saying about the way claims are handled and general satisfaction. Keep in mind that it does not do much good to get a low premium under the circumstances if the insurance provider takes a long time to respond to requests or denies claims unreasonably.

In summary, in choosing the best insurance plan for your pet business, you must consider what coverage you need to cover risks. With the right plan, you will have the protection for your business, your clients, and your future.

Common Mistakes to Avoid

Right before you finally decide on your pet business insurance, you need to know where most pet professionals go wrong. Even with good intentions, minor oversights can lead to substantial financial losses. Here are common mistakes to be aware of so you can avoid them later and save yourself time, money, and stress.

A. Skipping Coverage For Part-Time Or Mobile Work

Just because you do pet grooming only on the weekends or take dogs out for walks at night does not automatically put you out of harm’s way. Incidents can happen at any time. So if you opt out of a pet service business coverage, even a minor accident may cause serious financial problems.

B. Ignoring Fine Print Or Renewal Terms

Another mistake many pet business owners make is not to read the “fine print”. Many insurance companies will provide a new renewal term with changes to your coverage or increased premiums without notifying you. Some insurance companies may also have exclusions, such as in-home training or mobile pet grooming, unless you specifically added them to your original coverage. Thus, it is vital to read the entire insurance policy for pet professionals and verify that you are covered before assuming you are.

C. Underestimating Risks Like Animal Bites Or Damage.

Lastly, many pet business owners underestimate the risks associated with animal care. Pet bites, property damage, and escape accidents occur more frequently than you would imagine. Without reliable liability coverage for pet businesses, you may be financially responsible for veterinary bills, repair costs, and attorney fees.

Overall, it is easy to avoid making these mistakes by simply reading your insurance policy thoroughly and choosing pet business insurance that genuinely meets your needs.

Conclusion

Your pet business insurance is designed to protect the time and money you have invested in establishing your pet business, in addition to fulfilling all applicable state laws that govern the market. A pet business insurance provides you with a sense of security and confidence, knowing that you have taken the necessary steps to protect your pet business from the risks that exist in the pet industry.

Finding reliable and affordable pet business insurance is one of the most important business decisions you will ever make. It is not just a safety net but an investment in your growth, trust, and peace of mind in an increasingly competitive industry.

FAQs About Kennel Business Insurance

Q: Is pet business insurance legally required for all pet services?

A: While not all types of pet business insurance are universally mandatory, Workers’ Compensation is required in many states if you have employees. General liability is often essential for operational safety, even if not strictly legally enforced everywhere.

Q: Can my existing personal homeowner's or vehicle insurance cover my pet business?

A: Generally, no. Personal policies typically have exclusions for business activities. It’s crucial to have specific commercial policies for your pet business to ensure proper coverage for incidents related to your work.

Q: How often should I review or update my pet business insurance policy?

A: You should review your policy annually, primarily upon renewal, to check for any changes in coverage or premiums. Also, update it whenever your business services, size, or risks change significantly.

Q: What's the biggest mistake small pet business owners make regarding insurance?

A: A common mistake is underestimating risks like animal bites or property damage, or skipping coverage for part-time or mobile work, leading to significant financial vulnerability if an incident occurs.

Q: Are there any specific certifications or training required to get better insurance rates?

A: While not consistently directly reducing rates, having staff certified in pet first aid, CPR, or professional grooming/training can demonstrate a commitment to safety and professionalism, which reputable insurers value and may factor into overall risk assessment.